Do you always need a Radon Inspection Report for HUD multifamily project applications?

Radon detection and mitigation is a priority for the U.S. Department of Housing and Urban Development (HUD). Since 2013, HUD’s Office of Multifamily Housing policy has required radon testing and, if applicable, mitigation for most new FHA-insured construction, conversion and substantial rehabilitation projects, as well as most FHA-insured refinance transactions.

HUD requires a Radon Inspection Report be included in the applications of all FHA multifamily transactions – Multifamily Accelerated Processing (MAP) and Traditional Application Processing (TAP). The radon inspection report must be prepared by a radon professional who holds certification from the American Association of Radon Scientists and Technologists National Radon Proficiency Program (AARST NRPP) or the National Radon Safety Board (NRSB) as well as holds the applicable state licenses where required.

There are some cases where a Radon Inspection Report is not required, though always recommended.

- If a certified radon professional determines that radon risk is sufficiently low for the project.

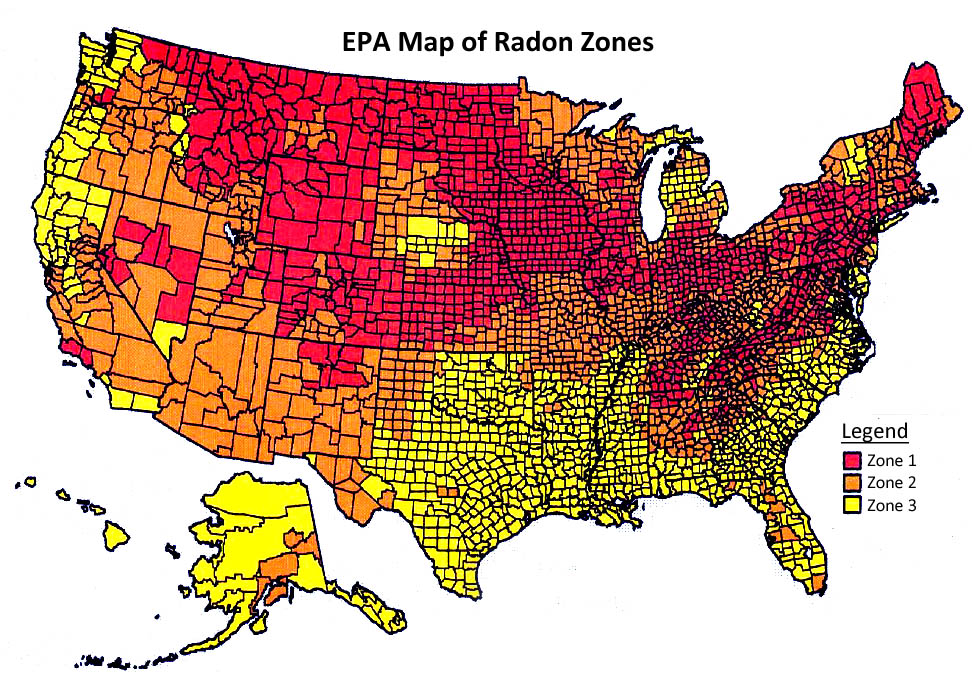

- Section 223(f) refinance project applications that have a low radon risk. To determine whether the project’s radon risk is low, the lender must first establish that the project is located in Zone 3 of the EPA Map of Radon Zones (map below).

- Section 223(a)(7) project applications (Refinance of original HUD insured mortgages: The policy encourages testing, but does not require it).

- If a project is located in Zone 3 of the EPA Map of Radon Zones (see below) and available state/local maps confirm low radon risk.

Publication Details

Date

May 5, 2016